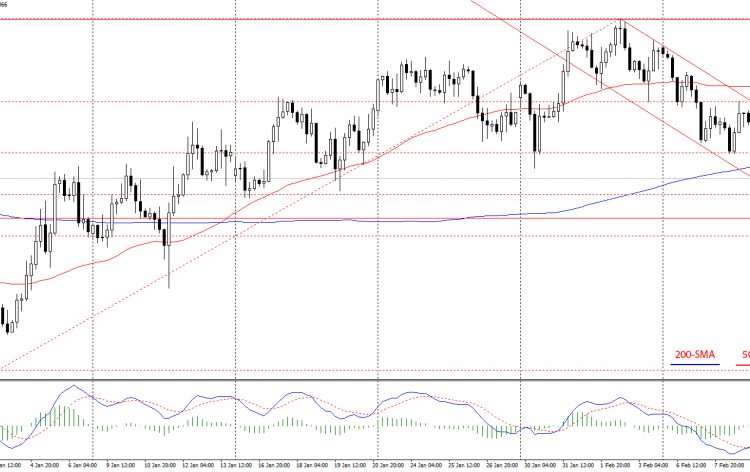

Last week, the EUR/USD was mainly bearish falling down below the 38.2% Fibonacci level. This week again started out on a negative tone for the euro. Earlier yesterday, ECB president Mario Draghi spoke on the EU economic forecasts. The quantitative easing measures in the region were raising inflation, but still being below the 2% target. Due to this, the statements by Draghi were dovish causing the euro to weaken.

Our hope of the ECB raising interest rates was dashed and this put a dent on the strength of the euro. In addition, data from Germany was also weak and being the largest economy in the region, the euro fell below 1.06. This euro weakness also made the pair of crossing below the 200 SMA (simple moving average) putting it in bearish territory.